Latest issue now available

At The Momentum Investor we pride ourself on finding those stocks that are likely to perform the best over the coming year and to sell those that are likely to perform the worst.

For 22 years the editor Richard Welby has been using a mixture of technical and fundamental analysis to make his share selections. Our team is continually sifting 100s of stocks, both large and small companies in our search, and it's a strategy that has in strong markets consistently produced outsized profits. So if you want a newsletter that looks under the bonnet, has a no fluff approach and a shoulder to lean on when things feel unsure, TMI is for you.

We are not in the business of wasting your time. In fact, any company we pick has to be going places and meet these three criteria:

We look at those shares which are showing relative strength against the market. Buying only those stocks that have shown good relative strength in the trailing year, also known as momentum, means we concentrate on 'leading' sectors (the top performing industries over the last 6 months or one of the sectors with the highest percentage of stocks making new highs). We occasionally add a further sieve to look at the trading volume to see if this has been rising recently.

We look at those shares which are showing relative strength against the market. Buying only those stocks that have shown good relative strength in the trailing year, also known as momentum, means we concentrate on 'leading' sectors (the top performing industries over the last 6 months or one of the sectors with the highest percentage of stocks making new highs). We occasionally add a further sieve to look at the trading volume to see if this has been rising recently.

At TMI once we've pinpointed stocks with strong price charts and strong sectors, we'll check the earnings-momentum side of the equation. Fast growth is the name of the game, so the company should have earnings that are growing very quickly, say 20-25% a year and whose earnings continually surprise the City by being higher than expected.

At TMI once we've pinpointed stocks with strong price charts and strong sectors, we'll check the earnings-momentum side of the equation. Fast growth is the name of the game, so the company should have earnings that are growing very quickly, say 20-25% a year and whose earnings continually surprise the City by being higher than expected.

If these criteria are met, we'll visit the companies, talk to their directors, review annual reports and analyse broker research. We'll crunch numbers, run projections, and talk to fellow professionals via our well-established market contacts.

If these criteria are met, we'll visit the companies, talk to their directors, review annual reports and analyse broker research. We'll crunch numbers, run projections, and talk to fellow professionals via our well-established market contacts.

You can view a list of the companies we've recently covered by doing a search or see the trending companies below.

A subscription gives you full and unlimited online access to our ENTIRE ARCHIVE in addition to receiving the newsletter in hard copy every month.

Subscribe and let me tell you more.

SUBSCRIBEWait, let me rewind. I know you might be thinking "who are you and why do you care so much?"

"Hi, My name is Richard and I specialise in looking for precisely these kinds of shares. Here are the basics: I've been editing TMI for 22 years and I specialise in looking for companies that fulfil these demanding criteria. My readers are fund managers, brokers and private investors. If you choose to stick around (and I hope you do) you will read about some great companies."

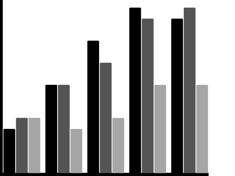

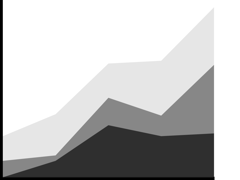

Based on the fact that individual companies can vary widely and some can fail altogether, The Momentum Investor introduced the capital growth "TMI Trader Portfolio", a virtual portfolio that is operated in the pages of the newsletter each month to demonstrate the dynamics involved in operating a momentum strategy and which works to the restrictions most private investors are faced with.

The original TMI Trader Portfolio was launched on 25 March 2002 with a starting capital of £100,000 After almost 19 years, it was wrapped up at the end of 2020 with a total gain of 518.7% (compared to the FTSE-All Share, which grew only 44.6% over the same period).

In 2021 we launched TMI Trader Portfolio 2 - a more relevant portfolio for our current readers. But remember, past performance is not an indication of future performance.

Read more

Want to see a sample issue before you subscribe? Just enter your email address below: