Latest issue now available

Momentum investors buy stocks that have "momentum" - companies that are improving at a faster rate than the market expects. These stocks exhibit very high relative strength, i.e. their price performance is better than all other stocks over the past 12 months.

Research by William O'Neill, a fund manager who's been running private investor seminars for the past 40 years, reveals that over 98% of those attending his seminars are inclined to buy stocks when they hit all-time lows in the mistaken belief that they must be ready to surge upwards. In most instances, this is simply not the case.

O'Neill's studies show that if investors had instead sunk their funds into stocks that were hitting new highs, they would have made much greater returns over the same period. In short, strong stocks are far more likely to climb higher, while weaker stocks are more likely to fall lower still.

Readers of The Momentum Investor won't have to fret over selecting the gems from the duds. We look at the best stocks to buy and describe in detail their merits.

Convinced?

SUBSCRIBE

The Momentum Investor applies its selection criteria equally successfully to the blue-chip categories of FTSE-100 and Mid-250 stocks, to FTSE SmallCap stocks and even to the Fledgling Index and AIM stocks. Using The Momentum Investor as your reference, you can decide whether you want to build a safety-first portfolio of leading shares or achieve a more aggressive balance of risk-reward with smaller companies.

Convinced?

SUBSCRIBE

The Momentum Investor has distinct technical and psychological advantages over approaches used by other investment publications.

In particular, it:

identifies the strongest stocks, even in slow or volatile markets

accustoms you to monitoring performance continually, so that you make periodic checks on your portfolio and take any action necessary

gives you the staying power to stick with strong stocks for years, rather than selling simply because you have profit

helps to detect weaknesses before they become to damaging

above all, trains you to sell weak underperforming shares and concentrate your attention and effort on winners

Convinced?

SUBSCRIBE

Whether you've just started investing or are an experienced shareholder, The Momentum Investor is for you. Written in clear, simple language, if you're a beginner, we'll help you avoid costly mistakes; if you're an old hand, we'll provide you with some useful insights and we hope to improve your stock picking success rate.

Convinced?

SUBSCRIBE

In difficult markets last year, the average performance of all 2023 main profiles and NAPS included in the newsletter, a virtual portfolio made up of 24 main profiles and 11 NAPS, is +11.8% (as at 15/1/24) and bear in mind, the companies profiled in the later months of 2023 have hardly had time to perform yet! In the same time frame, the FTSE-100 gained just +1.6% and FTSE-Small Cap +2.4%.

We also run The TMI Trader Portfolio within the pages of our newsletter each month. The rules are very simple; no stock joins the Trader Portfolio unless it has been profiled in the newsletter and just to be conservative, we don't include any dividend income but we do include dealing commissions.

The original TMI Trader Porftolio, which was launched on 25 March 2002 with starting capital of £100,000, was closed down at the end of 2020, at which point it was showing a gain of 518% (including dealing costs but excluding dividends) compared to the FTSE-All Share, which grew 44.6% over the same period. Remember, however, that past performance is not a guide to future success.

TMI Trader Portfolio 2 was launched in January 2021 with the aim of investing more aggressively; it is currently fully invested in 10 companies. Sign up to find out what those companies are.

But don't just take our word for it, ask your broker to run a check on our performance. Because quite simply our numbers can't lie, exaggerate or massage away poor performances.

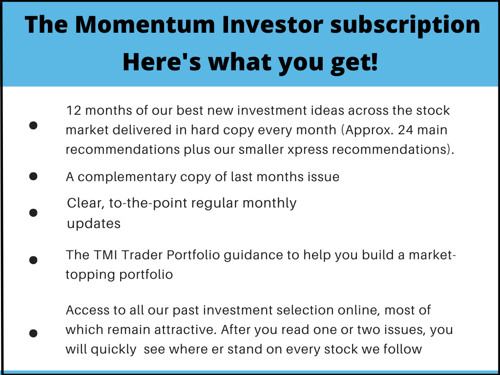

To get the full picture, you can access RECENT COMPANY PROFILES by subscribing now. You'll get the next 12 months issues plus INSTANT ACCESS to over 600 full articles!

Convinced?

SUBSCRIBE

Yes. There is always a hard core of companies which will do well come rain or shine and our methods are well suited to identifying them.

Convinced?

SUBSCRIBE

TMI is edited by Richard Welby who has been editor since 1999. The format includes two main company profiles, where we publish in-depth research, usually including information gleaned from one-to-one meetings with management. We also publish several shorter "Idea" pieces, which are often followed up with a full write up in the months that follow.

These are backed up by a comprehensive updates section, which provides news, analysis and the latest forecasts on companies covered previously. On TMI we never, ever leave you wondering about what happened to a stock or what you should be invested in. We clearly state whether we are buyers or sellers - and when. Past history is there for all to see at any time.

Given the fact that most investors only have a finite amount of money to invest, we also run a paper-based Trader Portfolio into which we try and select the "best of the best" of the shares we cover.

You can download a free sample issue on our homepage

Convinced?

SUBSCRIBE

Not only do you get the newsletter delivered to your doorstep every month and free access to every issue on our website but you will also receive a complimentary copy of the most recent issue as part of your welcome pack.

Convinced?

SUBSCRIBE

As momentum stocks are growing so quickly, they frequently announce more positive news than those which had been priced in by investors. This typically causes analysts to react by upgrading their profit and earnings forecasts which, in turn, often pushes the shares up further still. Momentum investing is the only system which provides investors with the discipline to stick with strong stocks and also to avoid and / or weed out the weaker shares from their portfolio - i.e. to run the winners and cut the losers.

Convinced?

SUBSCRIBE

Our criteria includes: excellent annual growth rates, strong and consistent earnings growth, high relative strength, high ROE and a presence in a "leading" sector which itself is growing strongly.

Convinced?

SUBSCRIBE

Yes. This is frequently when the company has reached a natural break in its growth cycle and the share price has topped. Rest assured, the Momentum Investor provides continuous reviews and also a stop-loss system to help protect most of your gains and / or cut losses before they become too heavy.

Convinced?

SUBSCRIBE

It is not part of our company policy to recommend a broker. One of the newsletter's main strengths is that it is totally independent and recommending a specific stockbroker would weaken this strength. We believe it is up to the investor to pick a broker that suits them. We suggest you get a list of brokers from the Stock Exchange (020 7797 1000).

Convinced?

SUBSCRIBE

If after subscribing at the first year discounted rate you decide The Momentum Investor is not the newsletter for you, just write in to our support team and let them know that you don't wish to renew. Please note -when you cancel your subscription, the cancellation will not be immediate, but will take effect from the end of your current paid for period.

Convinced?

SUBSCRIBE

Simply because our momentum investing philosophy consistently outperforms the market by a wide margin and produces superb results year in, year out. For example, in difficult markets last year, the average performance of all 2023 main profiles and NAPS included in the newsletter, a virtual portfolio made up of 24 main profiles and 11 NAPS, is +11.8% (as at 15/1/24) and bear in mind, the companies profiled in the later months of 2023 have hardly had time to perform yet! In the same time frame, the FTSE-100 gained just +1.6% and FTSE-Small Cap +2.4%.

SUBSCRIBE